The Central Bank Monetary Policy Committee on Tuesday, May 24, 2022, issued a statement announcing it had increased its benchmark monetary policy rate from 11.5% to 13%. This is the highest interest rate hike since July 2016.

In a communique where inflation was mentioned a whopping 28 times, the CBN cited rising inflation as a reason for the rate hike stating that the decision was intended to slow galloping inflation and save the persistent Naira depreciation. Here are the reasons the CBN gave this time for raising rates.

It will help moderate inflation and growth trade off

“On the need to tighten, MPC feels that tightening would help moderate the inflationary trade-off from the steady growth recovery so far. MPC also feels that tightening would help rein in inflation before it assumes a galloping trend, considering the progressive increase in headline inflation (m-o-m), particularly with the sharp 90 basis point increase in April, 2022.”

It will narrow interest rate margin

“Furthermore, MPC feels that tightening would narrow the negative real interest rate margin, improve market sentiment and restore investor confidence.”

Stem capital outflow and stabilize exchange rate

“Equally, members believe tightening would moderate inflationary pressure pass-through to exchange rate depreciation and moderate the speed of capital flow reversal, provide incentives for foreign capital inflows and sustain remittances. Lastly, tightening could moderate government domestic borrowing, as government debt servicing to revenue ratio increased significantly in recent times, threatening debt sustainability.”

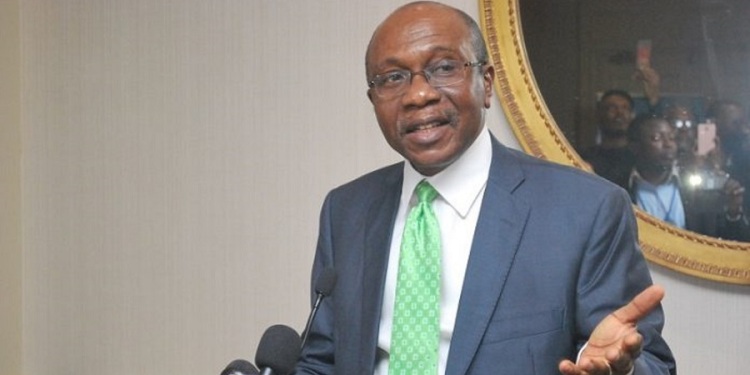

These reasons are in stark contrast to the CBN’s previous decision to keep rates flat when the committee last met. In the last MPC meeting held in March, the CBN Governor, Godwin Emefiele explained that a decision that requires a rising interest rate was essentially futile as it would not positively impact inflation rate.

“MPC also feels that not only would tightening reverse the steady improvement recorded in credit expansion, it is also of the view that tightening would not necessarily tame the inflation, particularly where the marginal decline is relatively not yet sustainable.” – MPC Communique

The CBN Governor, Godwin Emefiele was even more emphatic in his personal statements stating that a rate hike will upend economic growth.

“I acknowledge the recent unexpected rise in domestic inflation, which though, transient could justify arguments for tightening. But, importantly, economic 66 Classified as Confidential recovery is still fragile, while per capita income and unemployment rate are at unacceptable levels. My inclination today is to carefully balance the objective of price stability with output growth. Again, the dilemma of the trade-off between inflation and output remains extant, and I believe that a rate hike could upend our modest recovery,” Emefiele

Reading the contradictory statements that have resulted in a change of tune within two months, it appears the MPC had misjudged the level of hyperinflation in the economy. This is rather inexplicable when you consider the fact that the rising cost of goods and services has been prevalent and pervasive for months now if not years. Why did the CBN have to wait this long to recognize this issue and respond with an interest rate hike? And now that it has hiked rates, will it now negatively impact economic growth?

Firstly, the current rate hike is very unlikely to tame inflation considering the limited impact interest rates have on taming inflation. In Nigeria, inflation is more of a supply issue than demand so interest rates have little or no impact on its fluctuation. This is clearly about Nigeria’s exchange rate situation which the bank has now recognized as a major factor that it has lost control of.

The apex bank has perhaps come full circle after recognizing the impact leaving rates stable will have on Nigeria’s ability to attract foreign demand for its bonds. Nigeria’s 5-year Eurobond yields crossed 11% last week almost double its yield at issue, suggesting the market was already pricing in hyperinflation. The exchange rate at the parallel market also depreciated to N610/$1 reflecting the impact of scarcity of forex in the market. These twin factors clearly showed the apex bank’s policies were inadequate and out of touch considering the reality of the situation.

This latest flip-flop highlights some of the criticisms often labelled against the central bank and its monetary policies. The core objective of a central bank is price stability and full employment, two main mandates that we have failed to achieve over the years.